Starting in September 2023, Paid Leave Oregon will serve most employees in Oregon by providing paid leave for the birth or adoption of a child, a serious illness of yours or a loved one, or if you experience sexual assault, domestic violence, harassment, or stalking. Paid Leave Oregon makes sure employees can take paid time off to care for themselves or loved ones during life’s important moments.

What You Need to Know:

What benefits are provided through Paid Leave Oregon and who is eligible?

Employees in Oregon that have earned at least $1,000 in the prior year may qualify for up to 12 weeks of paid family, medical or safe leave in a benefit year. While on leave, Paid Leave Oregon pays employees a percentage of their wages. Benefit amounts depend on what an employee earned in the prior year.

What Qualifies?

Employees can take time off for three different kinds of life events:

Leave Type | Covered Leave | Maximum Leave Time |

|---|---|---|

Medical | Individual’s own serious health condition that requires inpatient care in a hospital, hospice or residential medical care facility Disabilities due to pregnancy Situations that are life-threatening, involve a terminal prognosis or that require constant care | 12 weeks |

Family | Care and bond with a new child during the first year after birth, adoption or placement through foster care Care for a family member with a serious health condition | 12 weeks 2 additional weeks for pregnancy complication |

Safe Leave | You or your child are a survivor of sexual assault, domestic violence, harassment, or stalking | 12 weeks |

Your Rights

If you are eligible for paid leave, your employer cannot prevent you from taking it. Your job is protected while you take paid leave if you have worked for your employer for at least 90 consecutive calendar days. You will not lose your pension rights while on leave and your employer must keep giving you the same health benefits as when you are working.

What Information Is PRotected?

Any health information related to family, medical or safe leave that you choose to share with your employer is confidential and can only be released with your permission, unless the release is required by law.

Who pays for Paid Leave Oregon?

Starting on January 1, 2023, employees and employers contribute to Paid Leave Oregon through payroll taxes. Contributions are calculated as a percentage of wages and your employer will deduct your portion of the contribution rate from your paycheck.

When do I need to tell my employer about taking leave?

If your leave is foreseeable, you are required to give notice to your employer at least 30 days before starting paid family, medical or safe leave. In an emergency, you must tell your employer that you plan to use Paid Leave within 24 hours. Follow up with a written notice to your employer within 3 days after starting leave. If you do not give the required notice, Paid Leave Oregon may reduce your first weekly benefit by 25%.

How do I apply for Paid Leave?

On August 14th, 2023, you can apply for leave with Paid Leave Oregon online at Frances Online or request a paper application from the Employment Department. Benefits begin starting September 3, 2023.

Contact Paid Leave Oregon

Phone: 833-854-0166

Email: Paidleave@oregon.gov

Contact BOLI

Phone: 971-245-3844

Email: help@boli.oregon.gov

Contributions Info & FAQ

What are contributions and when do they start?

Employees and employers will pay contributions to support Paid Leave Oregon starting on Jan. 1, 2023.

What are contributions used for?

Paid leave benefits for employees

Grants to help small employers when their employees use paid leave

Program administration

How much are contributions and HOW ARE CONTRIBUTIONS SHARED BETWEEN EMPLOYERS AND EMPLOYEES??

Contributions are a percentage of wages. The rate for 2023 is 1% of up to $132,900 in wages.

Employees pay 60% of the set contribution rate, and employers pay 40%. For example, if an employee made $1,000 in wages, the employee would pay $6 and the employer would pay $4 for this paycheck.

How are wages reported and contributions paid to the department?

Contributions are a payroll tax and will be included in combined payroll forms starting in January 2023. Employers will deduct employees’ paid leave contributions from paychecks. Employers will then report wages and pay both the employee and employer contributions through the combined payroll reporting process.

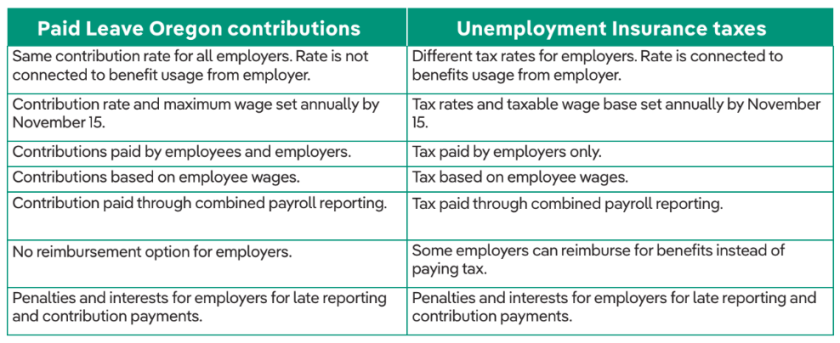

How are Paid Leave contributions different from Unemployment Insurance tax?

The Employment Department administers both Paid Leave Oregon contributions and Unemployment Insurance taxes. Below are some program similarities and differences.